Tony Borges, Marketing Communications Manager

As manufacturers plan automation initiatives for 2026, many are realizing that past efforts did not fail because of technology. They failed because of misalignment, hidden risk, and decisions made too late in the capital planning process.

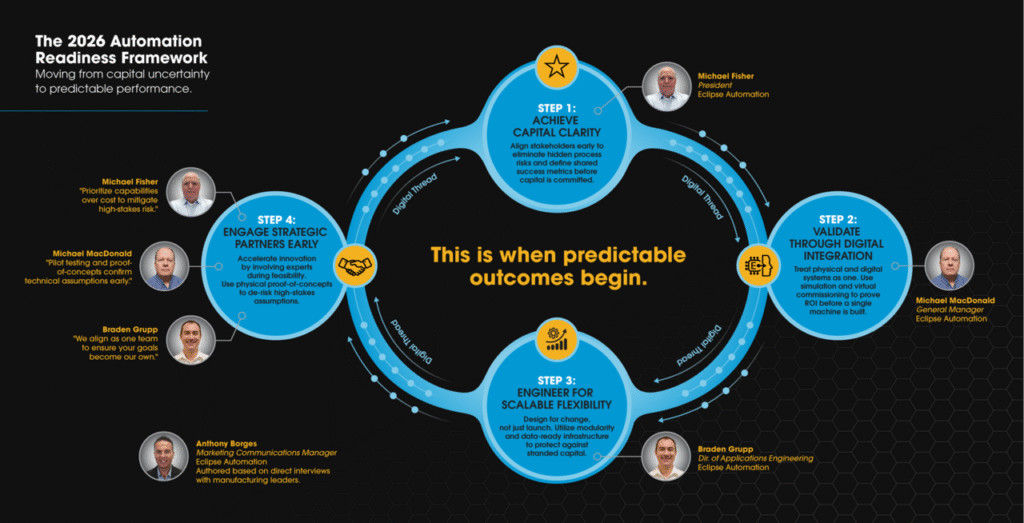

When viewed collectively, the perspectives of Eclipse Automation’s leadership team represent well over a century of combined factory automation experience across engineering, operations, and executive leadership. Their shared insight points to a consistent conclusion: Automation success today is determined less by equipment capability and more by how risk, readiness, and return are addressed before capital is committed.

In this article

- Why factory automation initiatives stall during capital approval, not execution

- How internal prioritization, competing CAPEX, and change management undermine ROI

- 4 essential steps manufacturers must take in 2026 to reduce automation risk

- Why structured data and digital validation matter before advanced AI

- How early partner engagement improves financial predictability

For organizations asking how to start factory automation in 2026, the answer is no longer about moving faster. It’s about making better decisions earlier.

The automation reality in 2026

For more than a decade, manufacturers have invested in automation with the promise of productivity, quality, and efficiency gains. In practice, many programs stalled, underdelivered, or struggled to achieve expected returns.

“Most automation programs fail because requirements are not defined properly on both the customer and supplier side,” says Michael Fisher, President of Eclipse Automation. “That creates variation in expectations and leads to costly assumptions before capital is even approved.”

The challenge today is not skepticism toward automation. It’s scrutiny. Automation projects must compete internally for capital, align across functions, and stand up to financial review. CFOs and executive teams are rightfully focused on ROI, risk exposure, and long-term asset value.

Automation success in 2026 is no longer defined by how advanced a system is. It’s defined by how well uncertainty is removed before execution begins.

Step 1: Align early to eliminate hidden capital risk

The first failure point in automation rarely appears on the factory floor. It appears during capital planning, when projects move forward without a shared understanding of readiness, scope, and risk.

“There is often not a clear understanding of project risks like process maturity, part tolerances, or system OEE,” explains Fisher. “Automation requires consistency in parts and process to be effective and reliable.”

Automation depends on consistency. Stable parts, mature processes, and defined performance targets are prerequisites for predictable outcomes.

From an operational standpoint, Michael MacDonald, General Manager at Eclipse Automation, sees the same pattern: “A lot of the risks that affect scope come down to product and process maturity. Products may be in market, but not mature enough for mass production, or there is pent-up demand and pressure to move quickly.”

When these gaps are underestimated, capital hesitation is not resistance. It is a rational response to uncertainty. “We often see products that were not designed for automation, or situations where teams try to automate too much or too little,” Braden Grupp, Director of Applications Engineering, adds, “there can also be a misunderstanding of ROI and what level of automation is actually required.”

This is where internal alignment becomes critical. Engineering, operations, quality, IT, and finance must agree on objectives, scope, and success metrics before RFQs are issued. Formal automation readiness assessments replace assumptions with evidence, giving decision-makers confidence that capital is being deployed intentionally.

Step 2: Treat automation as a connected system, not a collection of machines

Once alignment is established, the next risk emerges at the intersection of physical systems, controls, and data. As organizations digitize, automation systems must be designed as integrated environments, not isolated assets.

“Integration challenges arise across all areas,” says MacDonald, “but what we see trending is the digital side. As companies digitize, automation equipment must be data-ready, with hardware and software infrastructure defined early through a well-thought-out user requirement specification.”

Grupp reinforces this interdependence, saying: “In today’s connected world, physical layout, controls, data, and process flow are all truly linked. One problem cascades into the next if it’s not planned for.”

This is where digital validation changes outcomes. Simulation and virtual commissioning allow teams to validate process flow, cycle times, system handshakes, and data exchange before equipment is built.

“Simulation helps de-risk projects by validating tasks, handshakes, and data exchange. It allows us to visualize problems before they happen, identify bottlenecks, and optimize utilization while work is done concurrently with equipment build,” Macdonald notes.

Grupp extends this into advanced validation: “Digital twins allow teams to see through simulation issues that would otherwise only appear during controls commissioning. AI can be run on the digital twin, not live on the line, to evaluate scenarios safely.”

The key is sequencing. Structured data and validated models come first. Generative iteration allows teams to test and refine scenarios safely. Only then does generative AI become a meaningful accelerator rather than a source of risk.

Step 3: Design for change, not just launch

Automation investments must withstand shifting demand, evolving products, and market uncertainty.

Fisher frames the long-term risk clearly: “Customers should not take a short-term approach to automation. Early design considerations must include flexibility, modularity, and the ability to scale efficiently over time.”

From a system design perspective, “Less hard tooling and more robotics generally lend themselves to future scalability,” adds MacDonald. Modular stations that can be decoupled or reconfigured are far more adaptable than large, fixed automation.”

That flexibility connects directly to capital strategy. Grupp explains, Eclipse helps clients evaluate multiple scenarios. “Maybe they only have budget for a limited solution today,” he notes, “but when they see how small the cost difference is for a more flexible option, they choose to be future-ready now.”

Designing for change reduces stranded capital. Modular, data-ready systems protect investment by enabling adaptation without full system replacement. “If you are not collecting data, you are not ready for the future,” Grupp emphasizes, “You will not know the performance of your system or how to adapt when the next shift happens.”

Step 4: Partner early to accelerate innovation without increasing risk

Early partner engagement is often misunderstood as an added cost. In reality, it’s a risk-reduction strategy.

“Vendor selection should be evaluated first on capabilities and the ability to deliver on requirements, then on cost,” Fisher explains. “Decisions made on price alone are risky given what is at stake.”

That focus on capability is reinforced through early technical validation. “Proof of concept testing and pilot phases help confirm technical assumptions and can even lead to product design changes that make automation viable at scale,” adds MacDonald.

Grupp describes the partnership mindset: “We become part of the client team. Their goals become ours. Early involvement allows everyone, engineering, operations, capital buyers, even safety teams, to align around the same objectives.”

This is where advanced engineering services, automation labs, and digital twins converge. Virtual validation reduces uncertainty, while physical proof points confirm real-world performance before full capital commitment.

Leadership takeaway

Factory automation in 2026 isn’t about chasing technology. It’s about disciplined decision-making.

Organizations that succeed invest in readiness, digital validation, and alignment before committing capital. They address CFO concerns early, reduce uncertainty, and create predictable outcomes.

The first step in automation is no longer equipment selection. It’s Capital Clarity. This is when predictable outcomes begin. This is where factory automation is going.

About the experts

This framework is built on well over a century of collective experience in the design, build, and integration of complex manufacturing systems. By leveraging a vast strategic ecosystem of technology—including humanoid robotics, neural rendering (Gaussian splatting), high-fidelity digital twins, and advanced sensing—the team ensures that every automation project is validated and de-risked before capital is committed.

Michael Fisher, President

Eclipse Automation

With a career defined by operational excellence and executive leadership, Michael bridges the gap between technical execution and CAPEX discipline, ensuring that automation investments deliver high-value asset resilience and predictable ROI.

Michael MacDonald, General Manager

Eclipse Automation

Michael specializes in the digital transformation of the factory floor, focusing on removing uncertainty through Digital Validation and navigating the critical maturity gaps between product design and mass production.

Braden Grupp, Director of Applications Engineering

Eclipse Automation

An expert in technical de-risking, Braden leads the convergence of physical engineering and advanced simulation platforms, helping CFOs and operations teams visualize and optimize system performance before execution begins.